China’s NAND capability: a data-based deep dive

Datenna’s platform enables us to trace the domestic development of 3D-NAND technology in China from basic research and applied research and development (R&D) through to prototyping, acquisition, and ultimately, fielding.

But why is this important? Because NAND technology is a foundational military-civil capability that China has historically relied on foreign companies for supply. They enable everything from the smartphone in your pocket to precision guided missiles.

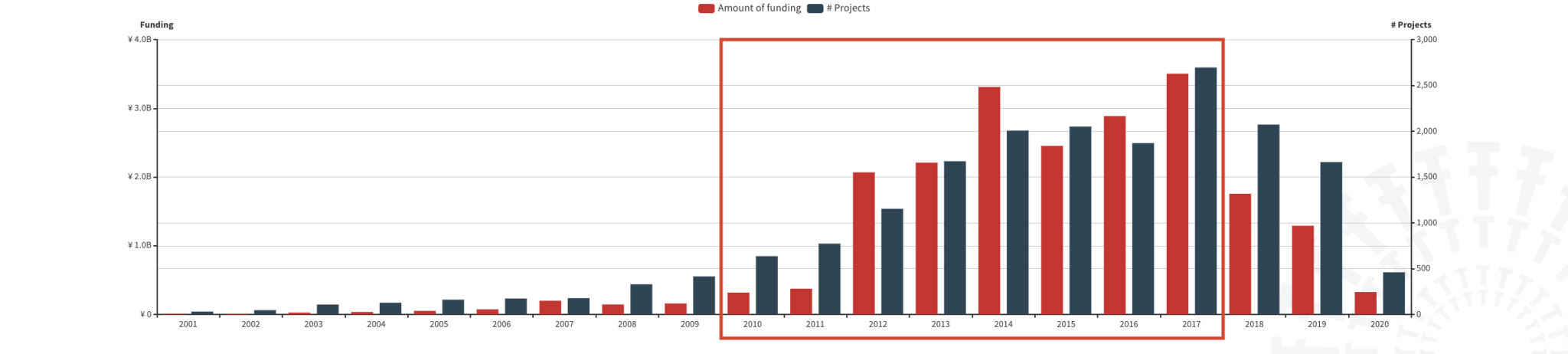

Using Datenna’s platform, we’re able to trace the activities that have fed into China’s domestication of this capability. As you can see in the figure below, Chinese state-funded R&D projects for 3D-NAND first began to accelerate in the early 2010’s, reaching a crescendo in activity by 2017, before tailing off towards the end of that decade.

Interestingly, the spike in funding occurred in the years immediately preceding the launch of China’s headline industrial strategy: Made in China 2025. These funding levels were then sustained through the early years following its inauguration – pointing to the CCP’s prioritization of strategic technologies such as NAND.

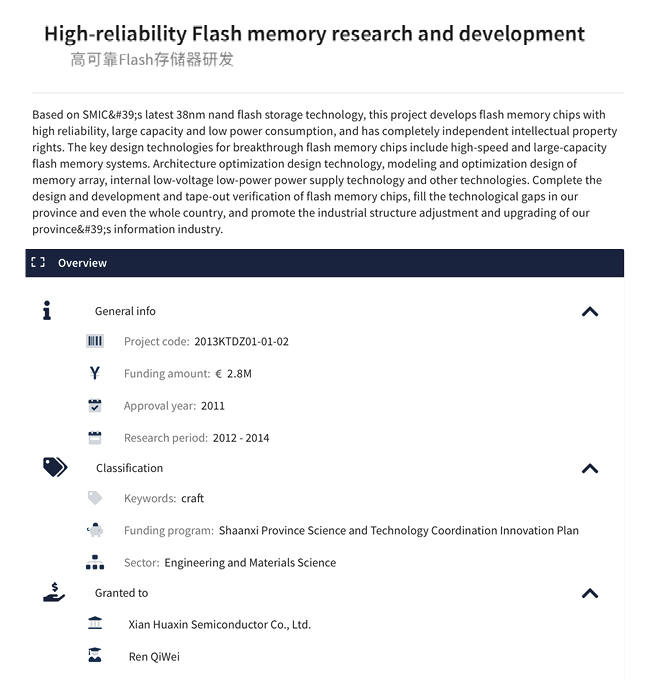

By drilling down into specific projects along this timeline across Chinese R&D institutes, we uncover indicators that signal progression through the incremental steps of capability development. As early as 2011, breakthroughs were occurring in the applied R&D stage (see figure below). By 2018, late-stage prototyping was underway, as evidenced by Dongxin Semiconductor Co. Ltd receiving funding to conduct advanced testing on the integration of 3D-NAND components into China’s 5G infrastructure.

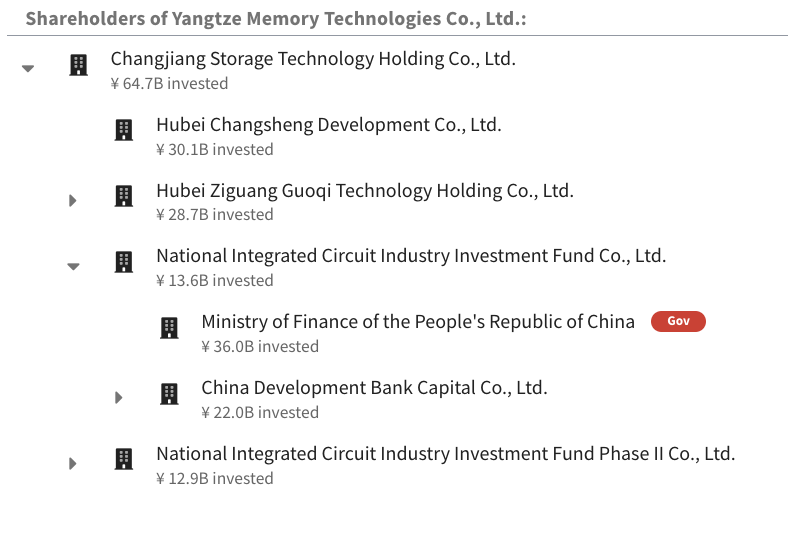

Another major milestone already occurred earlier, in 2014, with the launch of the “Big Fund”: China’s National Integrated Circuits Industry Investment Fund. This whopping investment vehicle (as of now worth almost $70 billion) is geared towards the domestication of China’s semiconductor value chain – an area in which they’ve historically been reliant on foreign vendors.

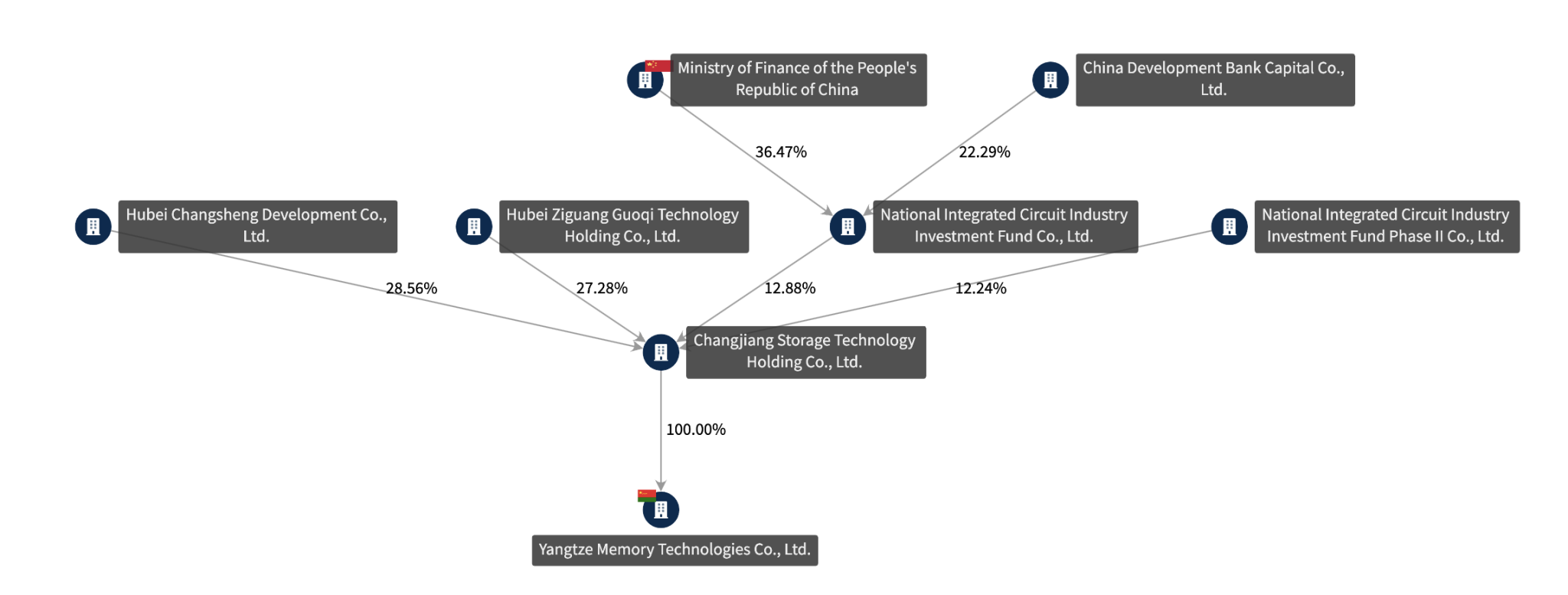

One critical recipient of capital from the big fund is Yangtze Memory Technologies Co. Ltd (YMTC), which specializes in NAND technology and is making progress at an astonishing rate. In fact, they were the first Chinese home-grown company to successfully manufacture 3D-NAND flash memory chips back in 2017. Today, their offering is a near-peer to well-known global players in the space, such as Micron and Samsung Electronics.

The figures below map out exactly how the Chinese State has supported the company financially, while holding majority ownership of YMTC. Meanwhile, their entire IP Portfolio has been filed from scratch since 2016 – another indicator of the pace with which China has developed domestic know-how.

YMTC has also caught the eye of Western governments: in 2022, the U.S. Department of Commerce added YMTC to its “Entity List.” This was done on the grounds that it was involved in Chinese military modernization. The following year, they received a further injection of cash from the Big Fund – $1.9 billion in total – to boost capacity.

This announcement came only two months before the Cybersecurity Review Office of the Cyberspace Administration of China made the decision to ban Micron – YMTC’s main competitor – from servicing Chinese customers. The decision was purportedly made due to Micron’s failure to pass a government security review.

While this article showcases just one key technology in a suite of capabilities considered critical by both China and the United States, it does provide a timely vignette on how their tech competition is unfolding.

Powered by Datenna’s platform, we have the data necessary to inform our understanding of China’s current techno-economic capabilities and their future aspirations. Delivering information superiority for economic security.

Discover more insights